U.S. CPI: Ouch

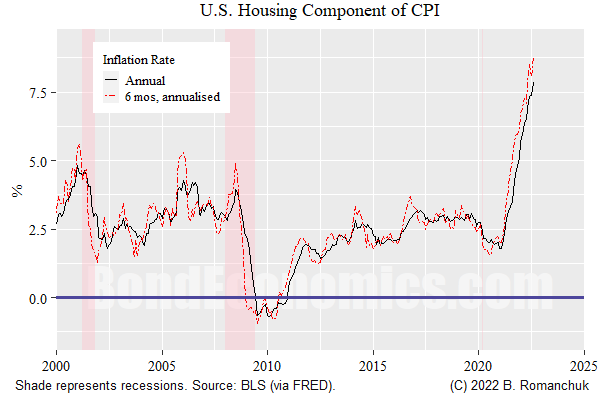

The CPI report in the United States was a horror show for Team Transitory. Although there were other areas with jumpy prices (e.g., food prices), I think that the housing component (above) is the part I am most concerned about in the near run.

The housing component of CPI is based on surveys that are smoothed. This means that there is a decent amount of momentum behind price trends. In the chart, I show the 6-month rate of change versus the annual rate of inflation. (When doing rates of change for periods under a year, you need to use seasonally adjusted data — like I did here — as otherwise you see a seasonal oscillation on top of the data.) The trend can change sharply — as seen in the past year, and in previous recessions. But we do not see the 6-month rate of change continuously chopping above and below the annual rate, which is what you would see in something like the energy component of the CPI.

So even if market rents start turning around, it will take considerable time for this to show up in housing CPI, and therefore core CPI (of which housing a major contributor). The question is: why exactly will the trend in rent increases turn around? Although one might hope that high rental prices will be the cure for high rental prices (as the saying goes in commodity markets), the demand response would be slower than in commodity markets. Rental contracts are typically annual, and there are a variety of “work arounds” for high rents (including returning to parents’ basements, going to a less attractive rental). My reading of the data is that recessions are the way that rent increases turned around historically.

In any event, average hourly earnings remains at an elevated level when compared to past decades. I see some arguments about the true state of the labour market, but my bias is to accept that wage costs are creating an upward bias to inflation relative to past cycles.

As such, the view that the Fed will be hiking rapidly until something breaks has to be taken seriously. The question is determining the timeline for the breakage (which I cannot really help the reader with).

One can imagine scenarios that are more bullish for interest rates, but they might require the Fed trying to convince people that elevated core CPI readings do not matter. Historically, they have been able to convince most observers to look through energy spikes (although the inflation nutters were never convinced), my guess it would be harder sell to get people to ignore core inflation. (I think the definition of core inflation is somewhat dubious, but it is quite popular and a useful shortcut for showing inflation trends.)