Term Premium Comments

I have been looking at term premium models as part of a non-writing project. I decided to take a look at the Kim & Wright model output (available via the Federal Reserve, paper link: http://www.federalreserve.gov/pubs/feds/2005/200533/200533abs.html). By way of background, there are two very popular term premium models, the Kim & Wright paper, and the one by Adrian, Crump, and Moench (ACM).

Working from memory, term premia estimates had difficulty around the COVID crisis, and at least one of the models stopped getting updates. I do not know whether the Kim & Wright series (above) had adjustments made to deal with the extreme data of that era.

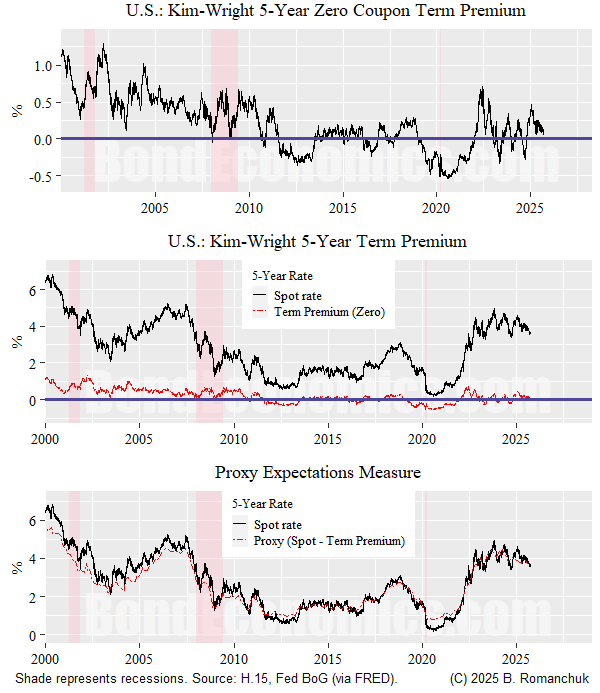

Although the usual approach is to focus on the 10-year, I wanted to stick to a shorter tenor so that it is a bit easier to approach. We do not really know what rate expectations “really are” on a 10-year horizon, but a 5-year forecast is somewhat plausible. So I looked at the estimate for the 5-year zero coupon rate.

The top panel shows the term premium (as a percentage, not in basis points) since the year 2000. By itself, the term premium is not particularly meaningful (unless yield levels have been scarred into your memory). The second panel shows the level of the par coupon 5-year Treasury and the term premium on the same scale (the term premium is far less volatile). The bottom panel shows the 5-year yield and an approximation of rate expectations — the 5-year par coupon yield less the 5-year zero coupon term premium. Note that this proxy will make some people angry — I am comparing a zero coupon rate and the par coupon yield. My excuse is that it will should directionally look like a better measured series.

Background: What is The Term Premium?

I have primers on my original blog (bondeconomics.com) as well as in my book Interest Rate Cycles: An Introduction.

To quickly recapitulate, we can decompose observed bond yields into two components:

the expected path of short rates over the life of the bond,

plus the term premium.

If the term premium is zero and the future overnight rate matches the “expected” path, the return on the bond to maturity will equal the return on rolling over risk-free cash at the overnight rate until the maturity date. That is, without a risk premium, the returns on bonds and cash are equal (referred to as “risk neutrality”).

In general, we see that government bonds that do not default outperform cash over long horizons (although there can be very ugly bear markets). (Defaults are the main ugly aspect of looking at very long horizon bond returns on an international basis, losing a war tends to wipe out bondholders.) As such, we have reason to suspect that there is a risk premium build into bond yields. The Kim & Wright and ACM models are attempts to measure the term premium on a consistent basis.

(On paper, you could try to use bond outperformance of cash — the realised risk premium — to try to get a handle on the term premium. The basic problem is that bond returns over the life of a bond are mechanically linked by the fact that the return over the lifetime of the bond is equal to the initial yield plus a small effect from coupon reinvestment at different rates. The Cochrane & Piazzesi approach is to attempt to model excess returns with forwards as an explanatory variable.)

If one wants to worry about the “sustainability” of government finances, one frets about rising risk (term) premia embedded in bond yields. However, to the extent that “fiscal risks” are manifested as high inflation (that the central bank would be expected to counter-act), this could show up as “rate expectations” and not a “term premium.”

“Looks Like a Moving Average”

If we look at the relationship between the spot rate and the “expectations proxy,” the proxy looks somewhat like a moving average of the spot rate, with some deviations in the level.

In the first decade, the term premium was volatile but had a positive average. This makes it look like a moving average that got shifted lower.

After 2010, the term premium average dropped to near zero, and so the expectations generally looks like a moving average. The main deviation is around the 2020 recession, where the term premium was quite negative and the expectations proxy is an offset above the spot level.

This behaviour is a mechanical effect of the methodology: spot yields are decomposed into two components (expectations and the term premium), and a good portion of the volatility of spot rates is dumped into the term premium estimate. We end up with nice smooth “expectations” and all the market action shows up in the term premium.

Interestingly enough, this behaviour is running backwards to the received wisdom of the mid-2000s bond sell off. The “Greenspan Conundrum” was about how bond yields rose less than the Fed Funds rate (link to retrospective article). Bond yields rising less than the Fed Funds rate is exactly what should happen in efficient bond markets, but this was not understood by older economists who were used to extreme gyrations in the overnight rate that caused wild reactions in the bond market. As we can see, the counter-cyclical nature of the term premium estimate means that the expected rate rose even slower than the observed yield.

Fans of QE Like These Results

The disappearance of the term premium (on average) after 2010 does fit the narrative of believers in the importance of central bank balance sheets in setting bond yields. The period in question was a period when the Fed grew its balance sheet as it panicked about various economic events.

My complaint about this situation is the implication that nobody is allocating any risk premium at the front end of the curve. Although there was obviously not enough of a risk premium a few years ago, it is less clear that nobody expects to make money doing leveraged trades at the front end of the curve (or is willing to take term risk if they could just roll money market maturities).

Any Lessons?

If we put aside my complaints about the plausibility of there not being a term premium, about the only take away from the model is that all the policy uncertainty of recent months has had no observable effect on the 5-year term premium. That said, we could probably have guessed that by looking at the chart of the 5-year yield.

I guess one would look at term premia in longer tenors, but it is unclear to me why the erratic policy preferences of a 78 year-old will have much macroeconomic impact in (for example) 2035. That said, interest rate markets are not perfectly efficient — the easiest place to express “oh no, fiscal risk!” worries is in the illiquid ultra-long end, and not the liquid belly of the curve that is used as a hedging vehicle for the private sector. (Remember that even American 30-year conventional mortgages are amortising, and so the effective duration matches the belly.)

Mr. Romanchuck,

Growth of balance sheet means the one time inputs into M2 of QE 1, 2, 3, and the 2020 Panic. What has a remaining effect in this context on interbank interest rates such as the overnight rate and Treasury rates was the policy changes:

1. In which central banks don't drain their own payments and

2. The IOR policy

#1 Sets #2 as the absolute ceiling on the overnight rate. If you disagree, perhaps argue the point with Mosler, whose idea it would seem to be.

Corporate bond rates, rather than bank demand, by #2, drive the two and five year note rates.

10, 20, 30 yr, layered upwards by your term risk, while pulled down toward (or now, the ten yr. is just below) IOR by #1, while held up by IOR-created illiquidity risk.

And the cash management bills and bills, well, as you said, along with the overnight rate, driven up towards, as Francis Coppola points out, the IOR rate by IOR-created illiquidity in the face of some residual overnight borrowing demand despite #1.

"For those who 'like' QE as an explanation"--an explanation preference model of the yield curve?