Things seem to be calming down in financial markets, which could be interpreted in one of two ways. The benign interpretation is that a few weak banks failed, but the rest of the financial system is in decent shape. The paranoid interpretation is that crises occur in stages, with pauses between the key failures. So far, I lean towards the benign interpretation — there are some areas of weakness, but not a lot of visible credit failures in the real economy. Things will deteriorate as the cycle ages, but such is the fate of capitalist finance.

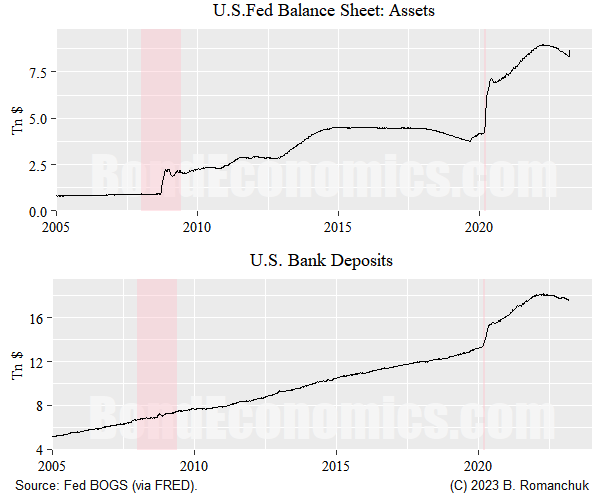

I just wanted to comment on bank deposits, which has been attracting some attention. My initial reaction is that we should expect some reversal in deposit growth as the Fed reverses its balance sheet growth. However, the figure above was not exactly what I expected.

The idea is straightforward. When the Fed is expanding its balance sheet by buying bonds, the ultimate sellers of bonds to the central bank have to either be banks or non-banks. (The Fed only deals with a limited number of counterparties, but they will typically act as intermediaries.))

If the seller is a bank, the bank swaps a Treasury for “reserves” (settlement balance at the central bank). This has no effect on deposits.

If the seller is a non-bank, the seller gets a bank deposit in exchange for the bond. (The banking system gets a deposit liability and a “reserves” asset.)

The bank deposit might be transferred around, but unless a transaction is done to eliminate it (e.g., repay a loan, bank issuing debt), total deposits in the banking system increases.

Of course, Fed interventions are not the only thing that will create/destroy deposits. Loan growth (for example) creates deposits.

I thought that this was straightforward, and created the figure at the beginning of the article to illustrate it. The 2020 episode acted as expected — large spike in the size of the Fed balance and deposits. What was surprising is the lack of movement of deposits in 2008. This is presumably the result of the initial wave of Fed purchases (the near vertical bit) was buying toxic assets off of the banks, and thus it had no effect on deposits. We only see the spike in 2020 since banks apparently saw less need to sell assets.

In any event, the recent slippage in deposits should not be too surprising when we look at Fed balance sheet shrinkage. The issue is how much this reflects weak credit growth as well. My eyeballing of the data suggests to me that the Fed shrinkage would be a major contributor to the contraction in deposits, but would not explain it all. Realistically, it would be more sensible to use other data sources than deposits to gauge what is happening in the economy. As such, I do not see any added value to my readers in trying to gauge what percentage of deposit shrinkage is explained by the Fed’s balance sheet shenanigans.

So aside from loan repayments outpacing new loans, QT destroys deposits because the Treasury is still having to fund principal payments to the Fed (including selling to non-banks) whilst the Fed isn't reinvesting all of the proceeds (fewer payments to non-banks)? I.E. deposits decline because of this new mismatch in transactions taking place between non-banks and the Treasury/Fed?

Hi Brian, when you say a bank buys UST by swapping them for reserves, do you mean the bank first creates a deposit to buy the UST, and then the Treasury transfers that deposit to the TGA, resulting in a swap by the bank (UST for reserves)? I mean, if a bank buys a corporate bond it creates a deposit, end of story right?